Best coinbase app software#

Armstrong explained if a firm is not storing customer funds they are regulated as a software company, rather than a financial service business. It is also possible to build wallets that are self custodial. Browse dapps, trade thousands of assets on decentralized exchanges (DEXes), earn with DeFi and staking, and collect NFTs.

Best coinbase app update#

The latest update for Coinbase Wallet extension brings full standalone functionality. He added: “That’s a great indication of trust that people have in centralised custody, especially our institutional customers who really want a qualified custodian.” “You’re going to see DeFi products and services surfaced within Coinbase app, either as third -party apps or more first-party apps and interfaces.”ĭeFi, or decentralised finance, lets customers recreate some traditional financial services in a decentralised way on a blockchain using smart contracts – such as lending their assets.Īrmstrong continued that most of the interesting developments in DeFi and non-fungible tokens (NFTs) will be through self custodial wallets.Ĭoinbase Custody was launched in 2018 and Armstrong said it now stores $255bn of crypto, approximately 10% of all crypto in the world. “Coinbase is going to embrace DeFi as we we think that’s a very important trend,” said Armstrong. He explained that although people think of Coinbase as a centralised exchange, the firm is aiming to become the primary financial account of crypto economy where customers can store assets, trade, lend and transact other services. “We’re helping bridge that gap between fiat money and crypto as we are regulated as a financial service.” “We are connecting into the traditional financial system,” he said. Coinbase generated $1.2bn in net revenue, marking the third consecutive quarter of more than $1bn in net revenue.Īrmstrong described Coinbase as a crypto company, rather than a financial services company or a technology company. In the third quarter verified users grew to 73 million and retail monthly transacting users (MTUs) were 7.4 million. “We’re seeing new hedge funds come in, we’re seeing new corporates come in, we’re seeing new all sorts of asset managers make an allocation to crypto,” she added. She continued that growth is coming from the the brokerage side as Coinbase can offer best execution via its smart order router. Institutional transaction revenue was $67.7m in the third quarter, down 34% compared to the second quarter.Īlesia Haas, chief financial officer of Coinbase, said on the third quarter results call that the vast majority of the volume is from market makers for both retail and institutional users. Coinbase said the decline in institutional trading volumes was driven by lower volatility. Institutional trading volume was $234bn in the third quarter, a decline of 26% from the second quarter, and nearly three quarters, 72%, of total trading volume. “I’m really bullish on our institutional business.”Ĭoinbase said in its shareholder letter for the third quarter results this year that clients including Pimco and Marex Solutions either began or continued their journey into the crypto economy with the firm, while enterprises such as Prosegur formed partnerships to use infrastructure products and services.Ĭheck out our shareholder letter, which includes Q3 financial results, and a quick recap below.

So that’s the set of features that are being built out and it’s a big investment for us,” he said. “We have provided post-trade settlement and margin. “We can help fan out those orders to every exchange out there over a period of a week or however long it takes.”Īrmstrong continued that institutional clients want Coinbase to support more assets and yield generation with staking. “Clients call us up who want to do $1bn-plus in trading with best execution and pricing that doesn’t move the market,” Armstrong added.

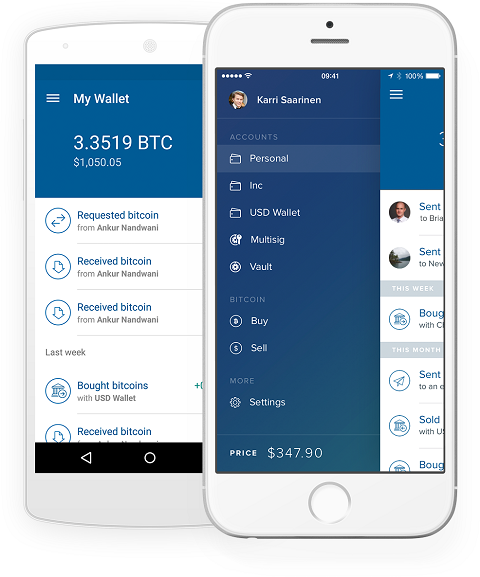

Coinbase Prime combines advanced trading, custody, analytics, and financing and has a smart order router.

Armstrong was interviewed by Fred Wilson, partner of Union Square Ventures and lead independent director of Coinbase, at the JP Morgan Crypto Economy Forum on 30 November.Īrmstrong said: “Our institutional business has been growing really well which I’m happy about.”Ĭoinbase initially addressed the institutional market by offering custody for crypto assets and then launched prime brokerage in the middle of the third quarter of this year.

0 kommentar(er)

0 kommentar(er)